Unmatched Convenience

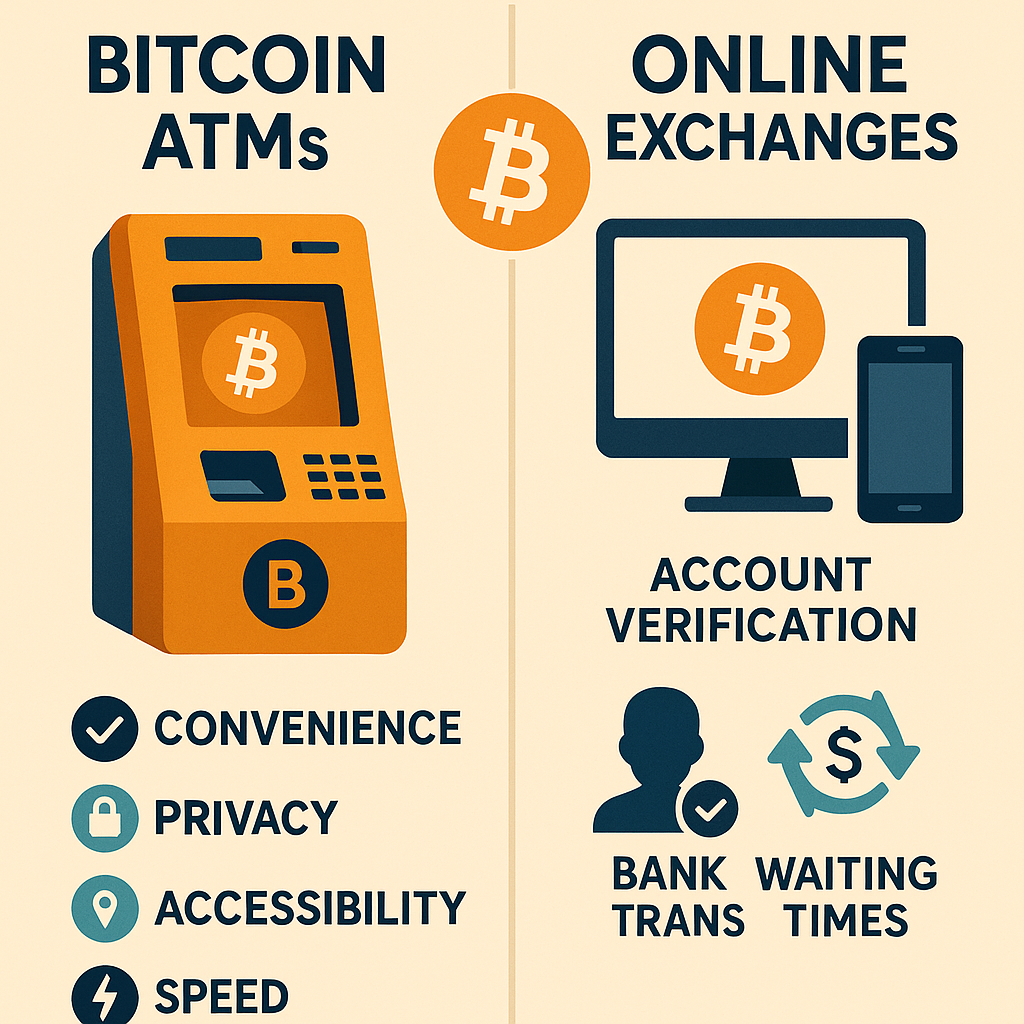

Convenience is at the heart of the Bitcoin ATM boom. Unlike online exchanges—which often require lengthy account setups, identity verification, and waiting periods for bank transfers—Bitcoin ATMs offer near-instant transactions. A user can simply locate a nearby machine, insert cash, and receive bitcoin in their wallet within minutes. Many ATMs are open late or even 24/7, located in high-traffic spots such as convenience stores, malls, and supermarkets. This means you can integrate a crypto transaction into your daily routine—buying bitcoin while grocery shopping or topping up your gas tank. For users who value speed and ease, the simplicity of walk-up, walk-out service is hard to beat.

Enhanced Privacy

Privacy is a top concern for many crypto enthusiasts, and Bitcoin ATMs often provide a greater degree of anonymity compared to online alternatives. While regulations differ by country and operator, many machines allow small transactions with little or no identity verification. This lower barrier to entry appeals to individuals who are uncomfortable sharing sensitive information or navigating mandatory Know Your Customer (KYC) checks required by most online exchanges. The option to buy or sell bitcoin without tying your transaction to a bank account or personal data is a significant draw—especially for those seeking more control over their financial privacy.

Broader Accessibility

Another major advantage of Bitcoin ATMs is their ability to democratize access to cryptocurrency. Traditional exchanges can be intimidating for beginners and are often inaccessible to those without bank accounts or sufficient technical knowledge. Bitcoin ATMs bridge this gap by providing an interface that feels familiar—mirroring the experience of using a regular ATM. Users can transact with cash, removing the need for complicated digital transfers or linked bank accounts. This makes Bitcoin ATMs especially valuable for unbanked or underbanked individuals, travelers, or anyone seeking a simple entry point into crypto without wrestling with online platforms.

Why Choose a Bitcoin ATM Over an Online Exchange?

There are several reasons why users may choose a Bitcoin ATM over a standard online exchange. First, the immediacy of transactions is appealing—users can convert cash to crypto (or vice versa) instantly, without waiting for bank approvals or transfer delays. Second, many people prefer the tangible, face-to-face nature of ATM transactions, which offer clear, step-by-step instructions and a direct interaction with the machine. For small transactions or first-time buyers, this can minimize confusion and anxiety. Additionally, some users distrust online exchanges due to security breaches or fear of hacking, preferring the physical interaction Bitcoin ATMs offer. Finally, ATMs let users buy or sell bitcoin without involving a bank, protecting them from unexpected account freezes or scrutiny.

What’s the Downside?

Despite the benefits, there are some downsides to Bitcoin ATMs that users should consider. The most prominent is the higher fee structure—Bitcoin ATMs often charge a significant premium compared to online exchanges, with fees typically ranging from 5% to 15% per transaction. Transaction amounts may also be limited, especially for those who want to remain anonymous or avoid identity verification. Lastly, while the number of Bitcoin ATMs is growing, availability can still vary sharply depending on your region—urban areas have more machines, while rural locations might have none.

Conclusion

Bitcoin ATMs are helping to bridge the gap between the digital and physical worlds, making cryptocurrency more tangible, accessible, and convenient than ever before. Their appeal lies in the speed and privacy they offer, as well as the ability to participate in the crypto economy using cash—sometimes without bank involvement or complex verification. While transaction costs are higher, for many users the advantages in convenience, privacy, and accessibility outweigh the fees. As cryptocurrency adoption continues to rise, Bitcoin ATMs are poised to play a vital role in welcoming new users into the world of digital assets.